In Part A-QD, the quantitative details of trading and manufacturing account are required to be furnished in respect of principal items. Fill up the information of items which are applicable. Part A-OI, contains details of allowances & disallowances under Income tax act. I t shall include: Creditors, Debtors, Bank balance, Fixed Assets, etc. 61-65 falling into respective income sectionsīalance Sheet of the business or profession as on 31st March of the FY in respect of the proprietary business or profession carried out. In case you are not required to maintain regular books of accounts, please fill up details at item No.

In case you were required to maintain regular books of accounts for the proprietary business or profession, please fill up details at item No. Profit and Loss Account for the financial year Further, in respect of supplies, closing stock and opening stock of finished goods, purchases, direct expenses, duties/taxes etc. Manufacturing Account for the financial yearįill in the opening inventory, purchases, direct wages, direct expenses, factory overheads and closing stock.įill up the details of Trading Account for the financial year such as Sales/Gross receipts of business/profession, duties, taxes and cess, etc. TAN of the collector, Name of Collector, Tax Collected, etc. TAN, Name of Deductor, Year of Deduction, Tax deducted, etc. TDS-2: Details of Tax Deducted at sources from Income other than Salary (As per FORM 16A) & Details of tax deducted at source on sale of immovable property u/s 194IA ( Form 26QB) TAN of Employer, Employer Name, Tax Deducted, etc.

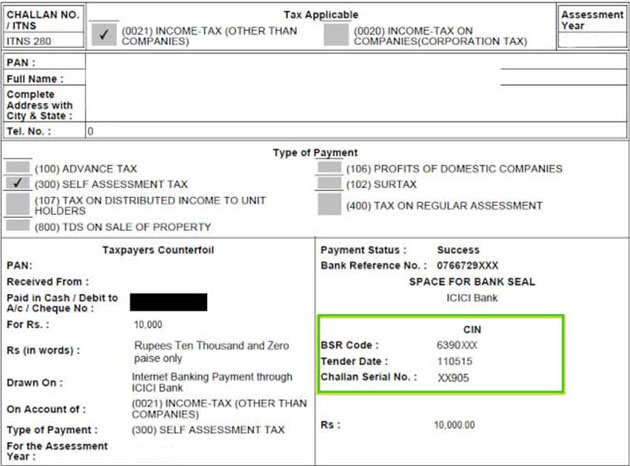

TDS-1: Details of Tax Deducted at Source from SALARY The Bank Account details, Verification, and TRP details (if any) are to be provided.ĭetails of Advance Tax and Self Assessment Tax PaymentsīSR code, Date of Deposit, Challan number, Tax Paid Total Income from all income sources, Losses of the current year set off, Gross Total Income, Deductions under Chapter VI-A.Ĭomputation of tax liability on total income

Name, Address, Date of Birth, PAN, contact details.Įmployer Category, Tax status, Residential status, Return filed under the section.

0 kommentar(er)

0 kommentar(er)